How Smart Planning Saved Dave $500,000 in Taxes (And Secured His Retirement)

Discover how Dave, a 56-year-old business owner, saved $500K in taxes and secured his family’s future — all through one smart financial move. See how strategic restructuring and a family trust turned his business exit into a legacy.

See the Full StrategyClient Information

Meet Dave

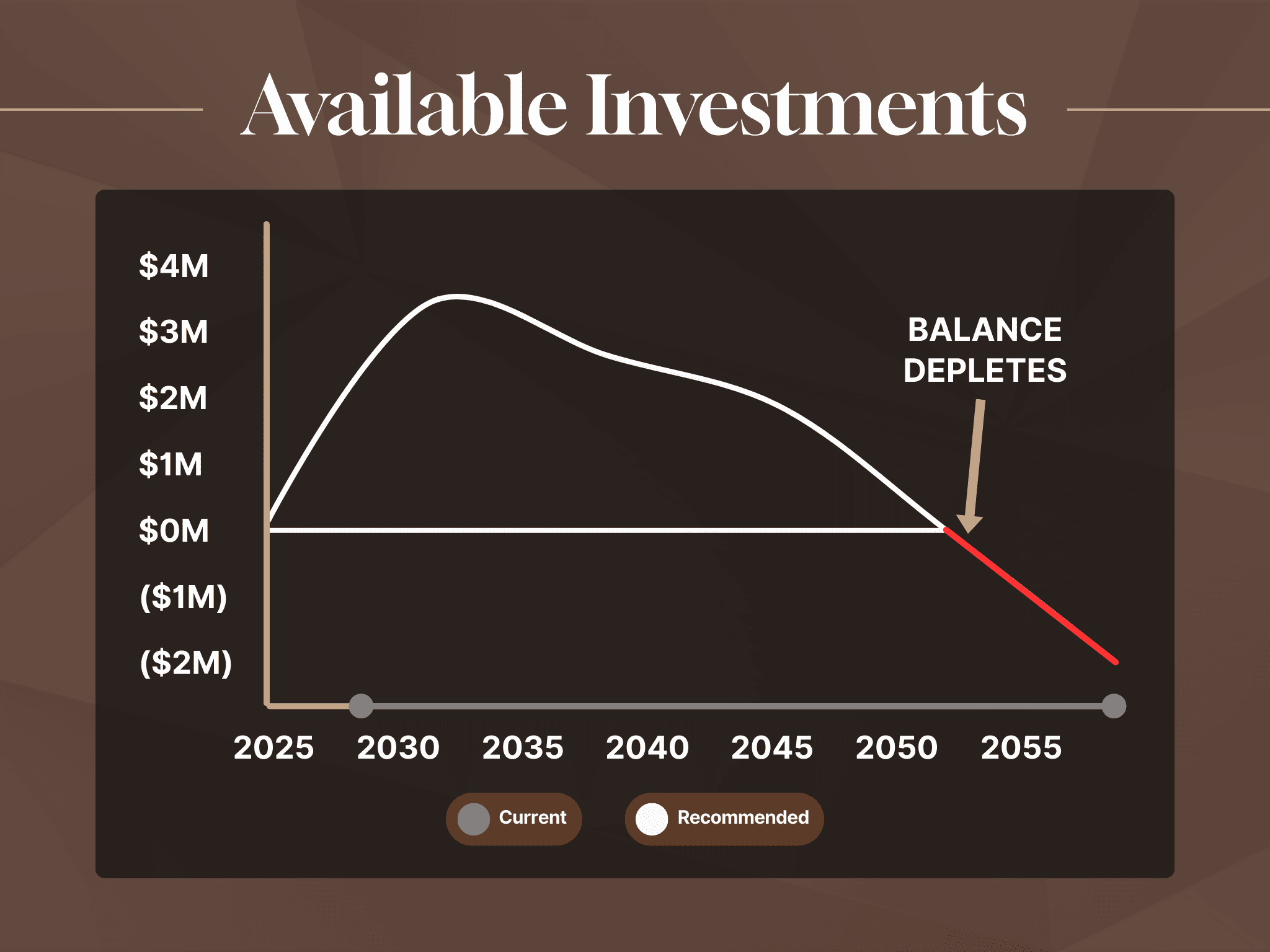

Dave was a hands-on business owner – the kind of guy who built his $2,000,000 company from scratch. At, 56, he was ready to retire, but there was a problem. Without realizing it, Dave was about to hand over nearly $500,000 of his hard-earned money to the CRA when selling his business. Worse? His retirement plan had a hidden time bomb: at his current spending rate, he’d run out of money in his 70s.

Discover below how we fixed it.

- Age: 56

- Business Value: $2,000,000 company

- Corporate Assets: $500,000 in corporate GICs

- Key Problem: Faced $500K tax bill; retirement plan would run out of funds by his 70s.

The Problem

Dave’s business was his golden ticket – but it wasn’t set up right.

He had $500,000 sitting in corporate GICs, which meant he wouldn’t qualify for the Lifetime Capital Gains Exemption (a $315,000 tax break for Ontario business owners). On top of that:

- His investments weren’t structured to sustain his $200,000/year retirement lifestyle.

- Without changes, he’d burn through his nest egg and be forced to sell his home, leaving little for his kids.

The Strategy

Two key moves saved him:

"Purifying" His Business

We reorganized his company’s assets to meet CRA rules, ensuring he qualified for the $1.25 million capital gains exemption. (No more GICs gumming up the works!)

Leveraging His Kids’ Exemptions

By setting up a family trust, we used one of his children’s unused exemptions to shelter another $750,000 of the sale — making the entire $2 million sale virtually tax-free.

The Outcome

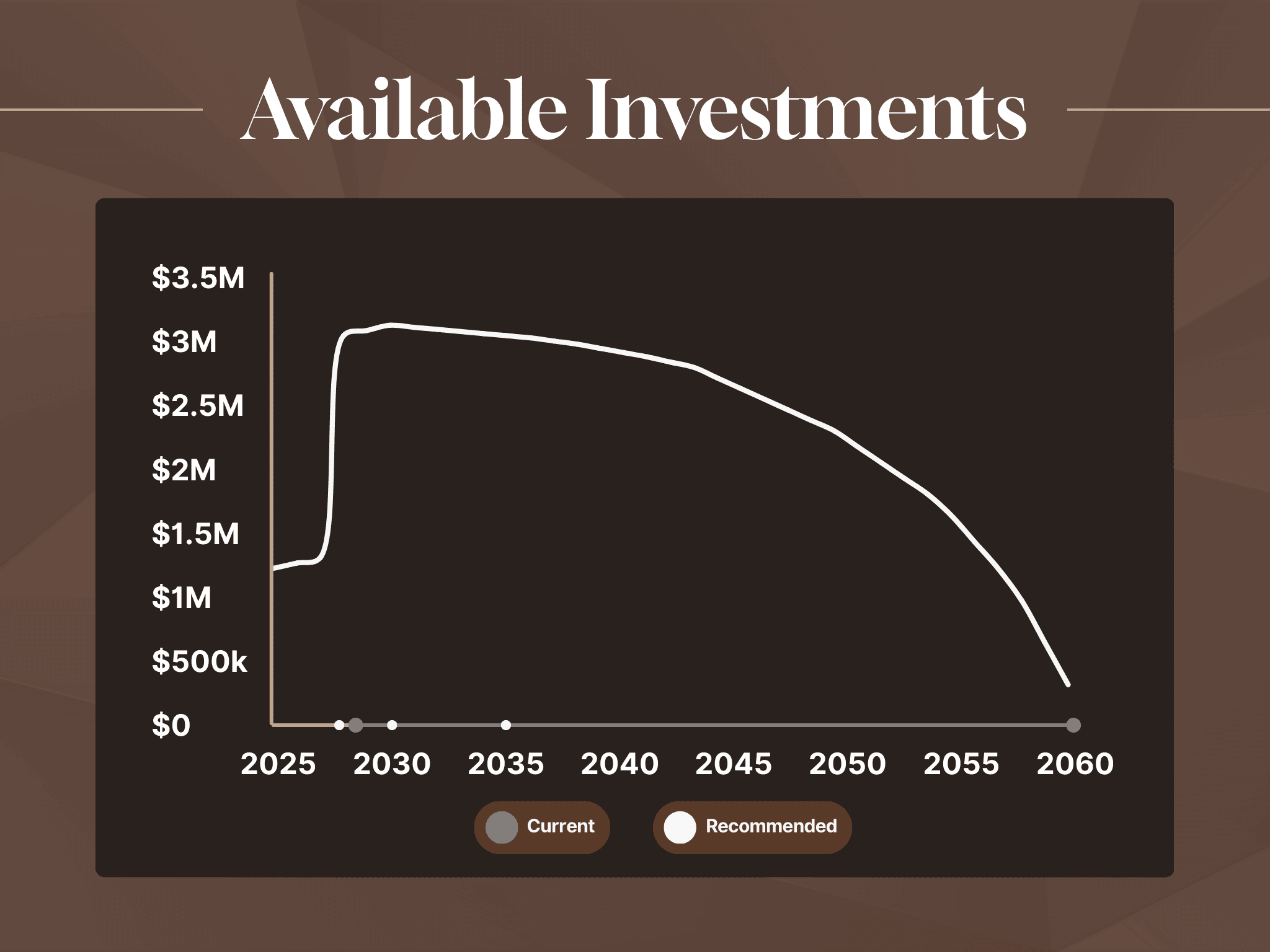

The Outcome: Tax Savings, Security & Legacy

- ✅ $500,000 Saved in Taxes

Kept half a million in his pocket—not the government’s.

- ✅ A Retirement Built to Last

His $200K/year lifestyle secured, with an inheritance preserved for his kids.

- ✅ Peace of Mind Achieved

Confidence that his business exit and future were optimized—no regrets.

The Lesson for Business Owners

Many business owners don’t realize how much tax they’ll owe when they sell. Worse, they often miss out on simple strategies that could save them hundreds of thousands. Dave’s story isn’t unique—but with the right planning, his ending doesn’t have to be yours.

Want to make sure your exit plan is tax-smart? Let’s talk. A few moves now could save you a fortune later.

Note: Results vary based on individual circumstances. Investing involves risk including potential loss of principal.