How Smart Insurance Planning Added $446,000 to a Family's Inheritance

How life insurance saved a business-owning family $446K in inheritance taxes.

See the Full StrategyClient Information

Meet Jim and Pauline

Most business owners don't realize they're potentially leaving hundreds of thousands on the table for the CRA. Jim and Pauline almost made that exact mistake.

This retired couple had built a successful business and accumulated $3 million in personal and $1 million in company assets. At 75, they weren't worried about retirement income - they wanted to maximize what they'd leave their kids and grandkids while minimizing taxes.

- Age: 75

- Personal Assets: $3 million

- Corporate Assets: $1 million in corporate investment account

- Financial Goal: Maximize inheritance for kids/grandkids

The Problem

Here's the problem we uncovered:

Their $1 million corporate investment account would grow to $1.5 million over 14 years. But when their kids eventually accessed that money, over $600,000 would disappear in taxes.

That's nearly half!

The Strategy

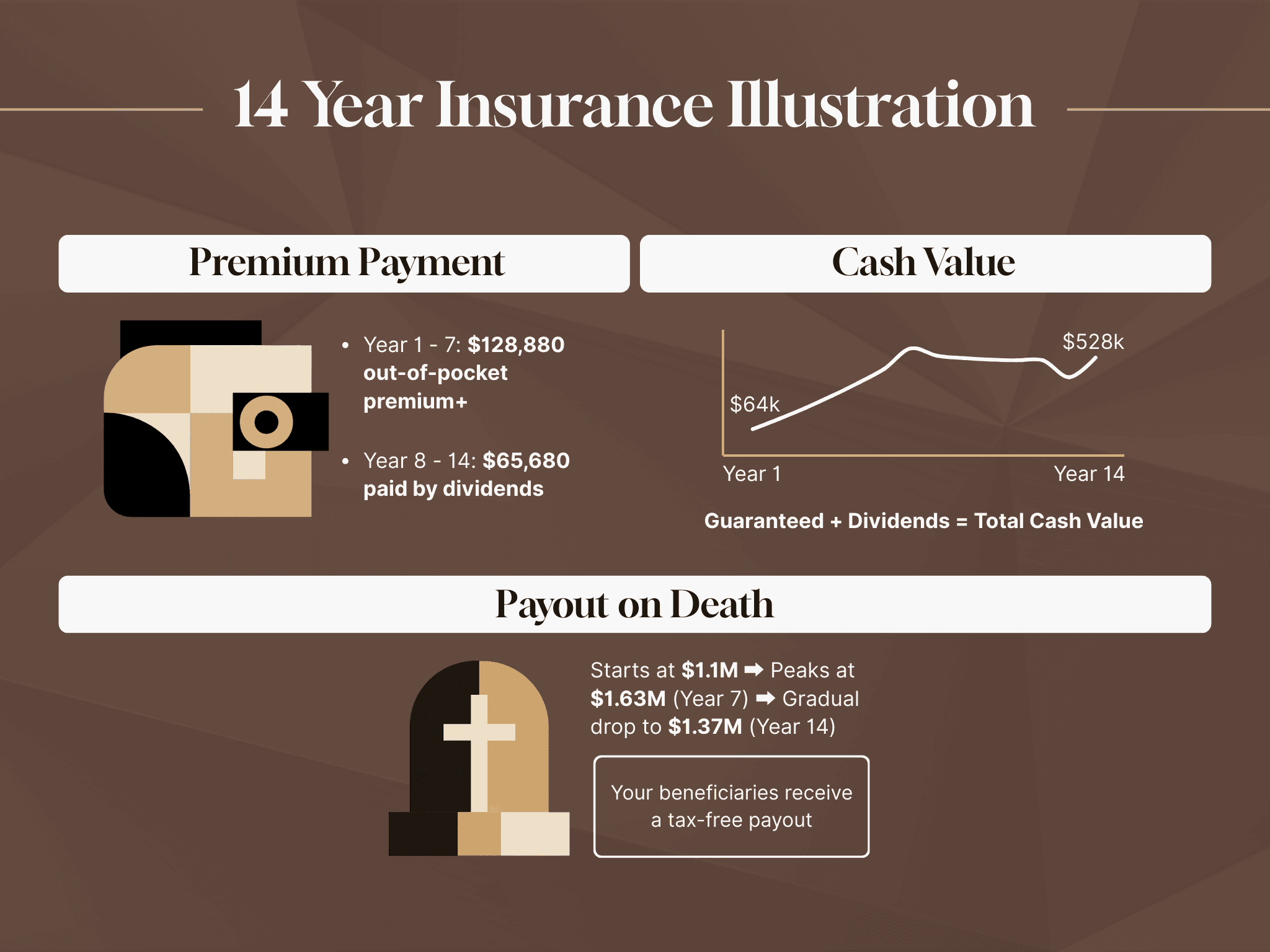

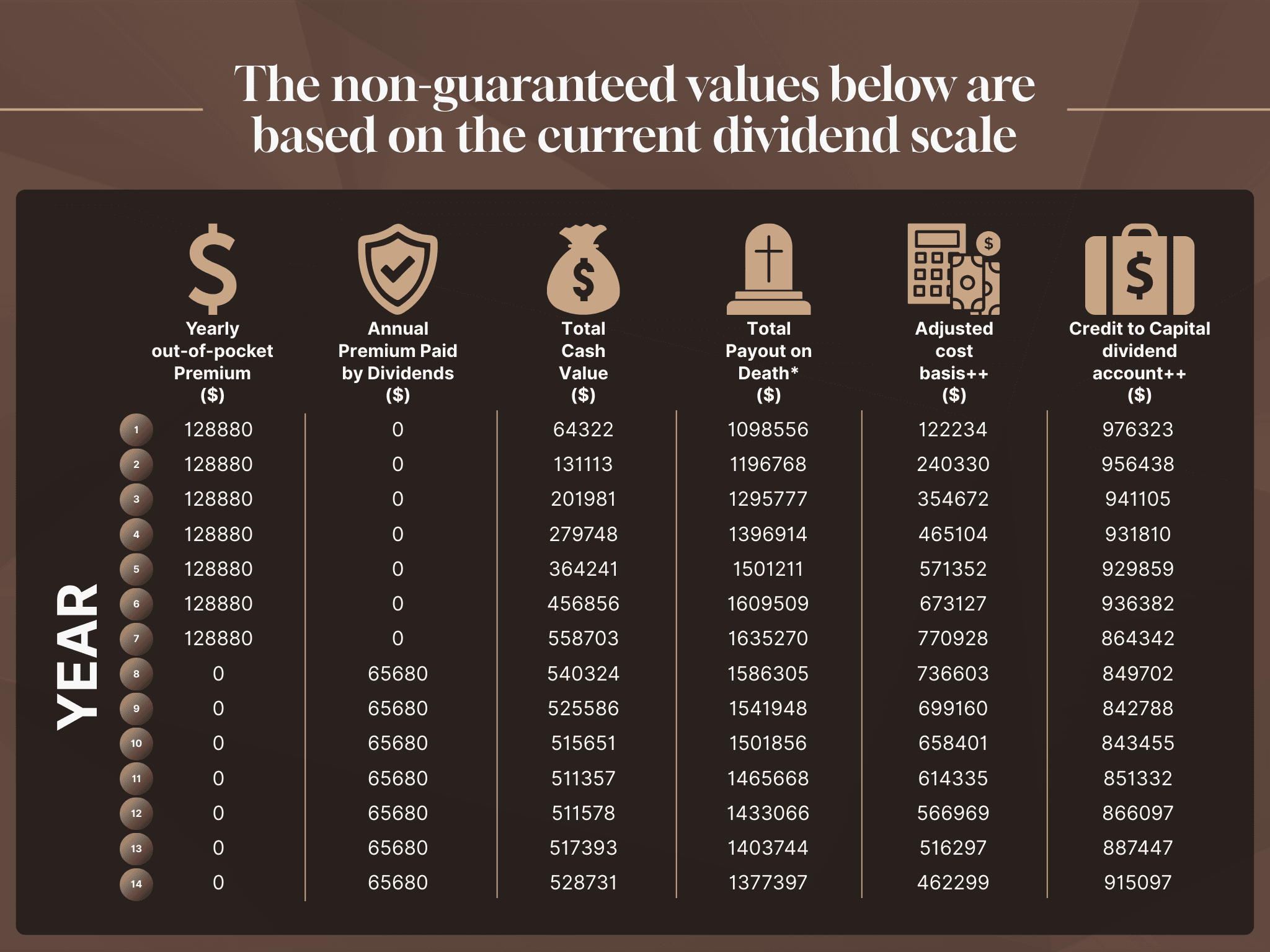

The solution? We repositioned their corporate investments into a specially-designed life insurance policy. Here's why this worked so well:

Tax-Free Growth

The policy's investments grew sheltered from taxes

Tax-Free Payout

$915,000 could be distributed to their kids tax-free

Better Returns

The policy delivered a 9.5% return - better than traditional investments

The Outcome

The results spoke for themselves:

Original plan: Kids receive $880,000 after taxes

New strategy: Kids receive $1,326,000

Total family benefit: +$446,000

The best part? This wasn't some exotic scheme. It used straightforward insurance principles available to any incorporated business owner with surplus funds. The key was structuring it properly to unlock these tax advantages.

This case shows how proactive planning can dramatically impact what stays in your family versus going to taxes. For business owners with corporate investments, these strategies can be game-changers.

Want to see if your business assets could work harder for your family? Let's talk - you might be surprised what's possible.

Note: Results vary based on individual circumstances. Investing involves risk including potential loss of principal.