How Smart Corporate Investing Helped a Farming Couple Boost Retirement Savings by $900,000

Josh and Stacey boosted their retirement savings by $900,000 by shifting idle corporate cash into smarter, tax-efficient investments—reaching their $4.5M goal with room to spare.

See the Full StrategyClient Information

Meet Josh and Stacey

Most business owners don't realize they're leaving thousands on the table by keeping corporate cash in low-interest accounts. Josh and Stacey were no different - until we optimized their strategy.

This hardworking farming couple (both 45) had built a successful business near Hamilton. They were saving $10,000 monthly in their corporation – but that money was just sitting in a savings account earning minimal interest. Their goal? Retire at 65 with $4.5 million to sustain their desired lifestyle.

- Age: 45

- Occupation: Farming couple / Business owners

- Corporate Savings Rate: $10,000/month

- Retirement Goal: Age 65 with $4.5 million

The Problem

Here's the problem we fixed:

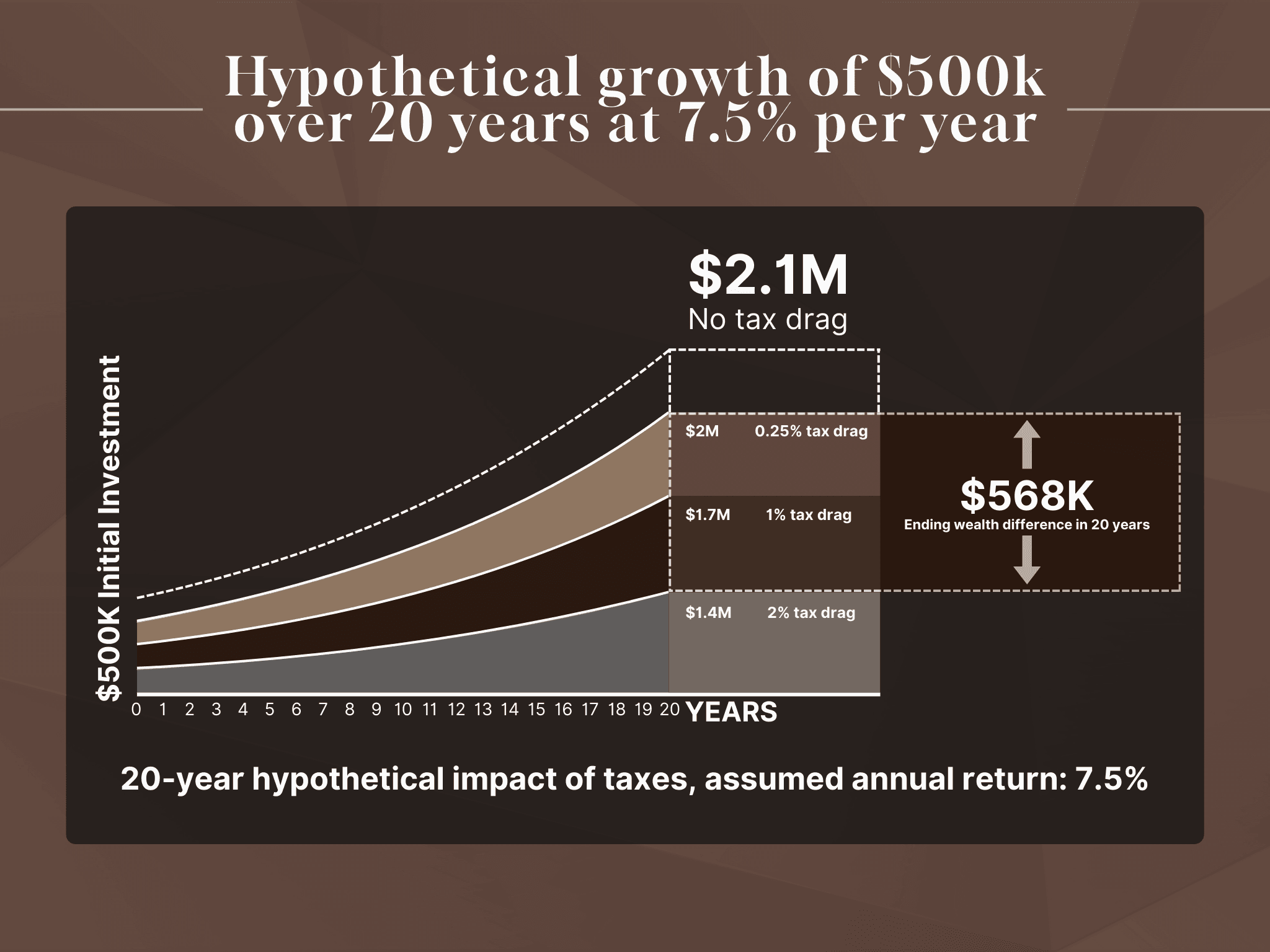

- Tax Drag: Ordinary corporate investments lose about 2% annually to taxes

- Missed Growth: Their current approach would leave them $600K short of their goal

- Inefficient Structure: They weren't maximizing their corporate tax advantage

The Strategy

We implemented three key changes to help Josh and Stacey maximize the value of their corporate savings:

Shifted to Tax-Efficient Corporate Class Investments

Instead of leaving their monthly $10,000 savings in a low-interest corporate account, we redirected those funds into corporate class investments. These are specially structured to defer and reduce taxes on investment income within a corporation—leading to more compounding and faster growth over time.

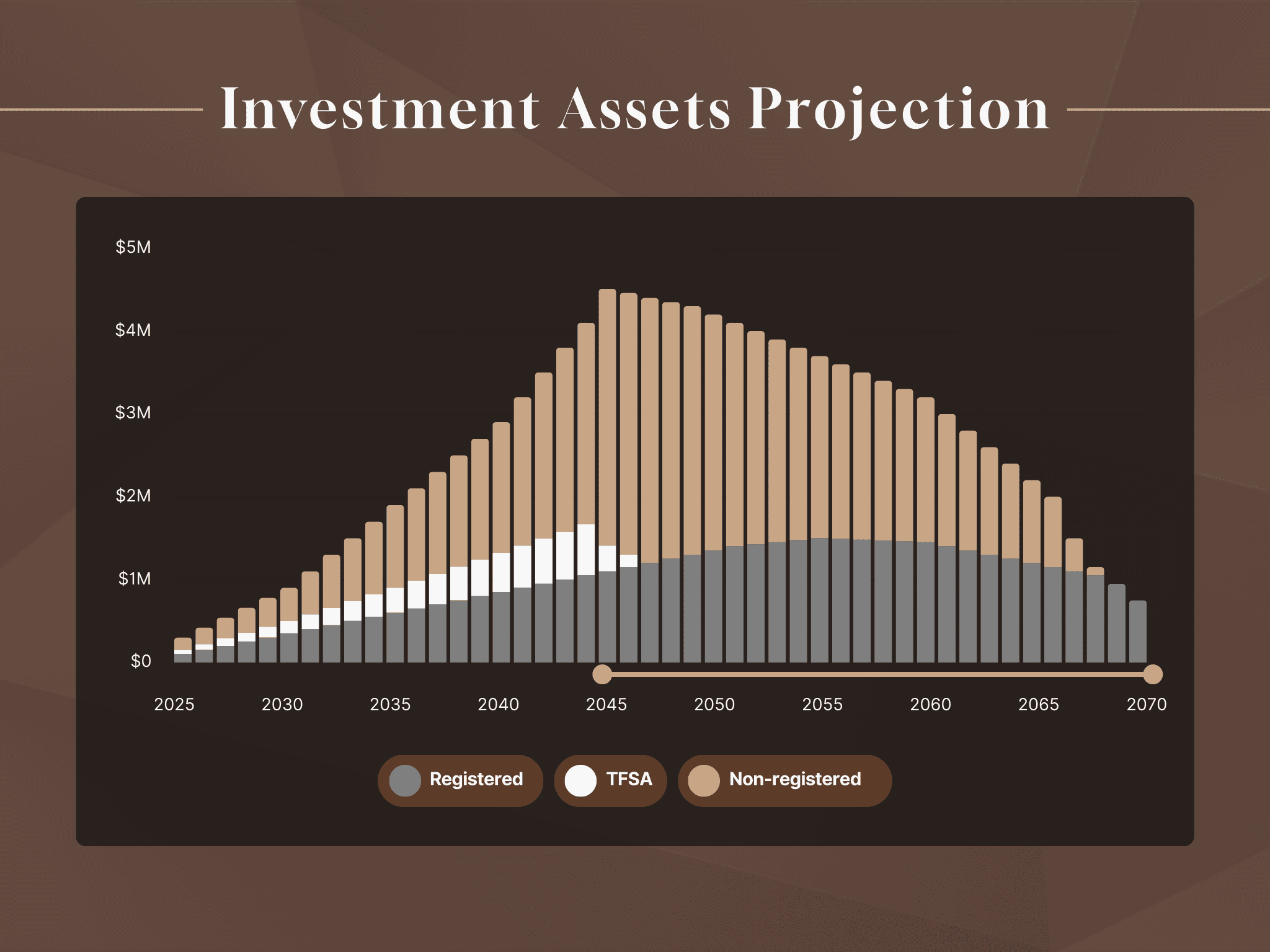

Balanced Corporate and Personal Savings

We restructured how they were saving by introducing a mix of corporate and personal investment accounts. This allowed us to reduce future tax liabilities, optimize withdrawal strategies in retirement, and make better use of their available contribution room across both account types.

Maintained a Low 12.2% Corporate Tax Rate

By carefully managing their corporate investment strategy and expenses, we ensured they stayed within the small business tax bracket. That meant more after-tax income available to invest and grow—without pushing them into a higher tax tier.

The Outcome

Smarter Planning, Bigger Wealth

- Original projection: $3.9 million at retirement

- Optimized approach: $4.8 million

- Total gain: +$900,000

This isn't magic - it's just smart financial planning. By understanding corporate investment rules and using the right tools, we helped Josh and Stacey:

✅ Comfortably Hit Their Retirement Goal

✅ Slash Annual Investment Taxes

✅ Keep More Money Growing for Their Future

The Key Takeaway

Business owners have unique advantages - but only if you use them properly. A few strategic moves now can mean hundreds of thousands later.

Want to see if your business savings could work harder? Let's talk - your future self will thank you.

Note: Results vary based on individual circumstances. Investing involves risk including potential loss of principal.